Форекс търговия за начинаещи: Forex стратегии за България за 2026 г.

The Forex trading market is one of the largest financial markets in the world. Over $5 trillion worth of currency is traded every day. If you are interested in joining this trading market, this forex trading guide for beginners will give you all the information you need.

We will explain how Forex trading works in Bulgaria, point out its advantages, and offer you some strategies and tips so you can start trading Forex. We will also look at five of the best Forex brokers to trade with.

How to start trading forex in Bulgaria – a guide to forex trading

Are you ready to trade forex? We’ll show you the steps to place your first order:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

What is forex trading?

You’re probably wondering “what is forex trading?” Forex trading is the exchange of one currency for another.

You’re probably wondering “what is forex trading?” Forex trading is the exchange of one currency for another.

For example, if you have ever exchanged levs for euros, dollars, British pounds or any other currency while on vacation, then you have participated in one aspect of forex trading. Of course, when we talk about Forex trading in Bulgaria, we mean trading currencies with the aim of profiting from changes in their value.

One of the exciting things about forex trading is that the market is global. This is different from stock trading, where traders typically trade shares of companies from one country. When you trade forex, you are participating in a market that involves governments, banks, and traders from all over the world.

The forex trading market is huge, with $5 trillion worth of currency traded every day. This volume is determined by the fact that the forex market is important not only for currency traders, but also for the global economy.

For example, if you want to buy clothes made in China, you will pay the company that imports them in leva or euros or dollars, and they will in turn pay the manufacturer probably in yuan or dollars. That is why currencies are traded by leading banks.

Forex trading is conducted 24 hours a day, 5 days a week – from 9 am on Sunday to 9 pm on Friday. There is no main exchange in forex trading, as there is in stock trading.

A currency order is placed on a global computer network and can be executed by a forex broker, bank, or other person who trades on the global network. Since online currency trading takes place all over the world, the market can be very active at any time of the day.

Currency pairs

One of the key things that beginners to forex trading in Bulgaria need to know is that all currencies are valued against each other. This is another key difference from trading stocks.

The pound, for example, has no set value on its own. Instead, the value of the pound is measured against, say, the dollar or the euro. The value of the British pound can rise against the dollar and the euro by different amounts, or it can rise against the dollar and fall against the euro at the same time.

Forex trading is done using currency pairs. There are three types of currency pairs for Forex trading:

Major currency pairs

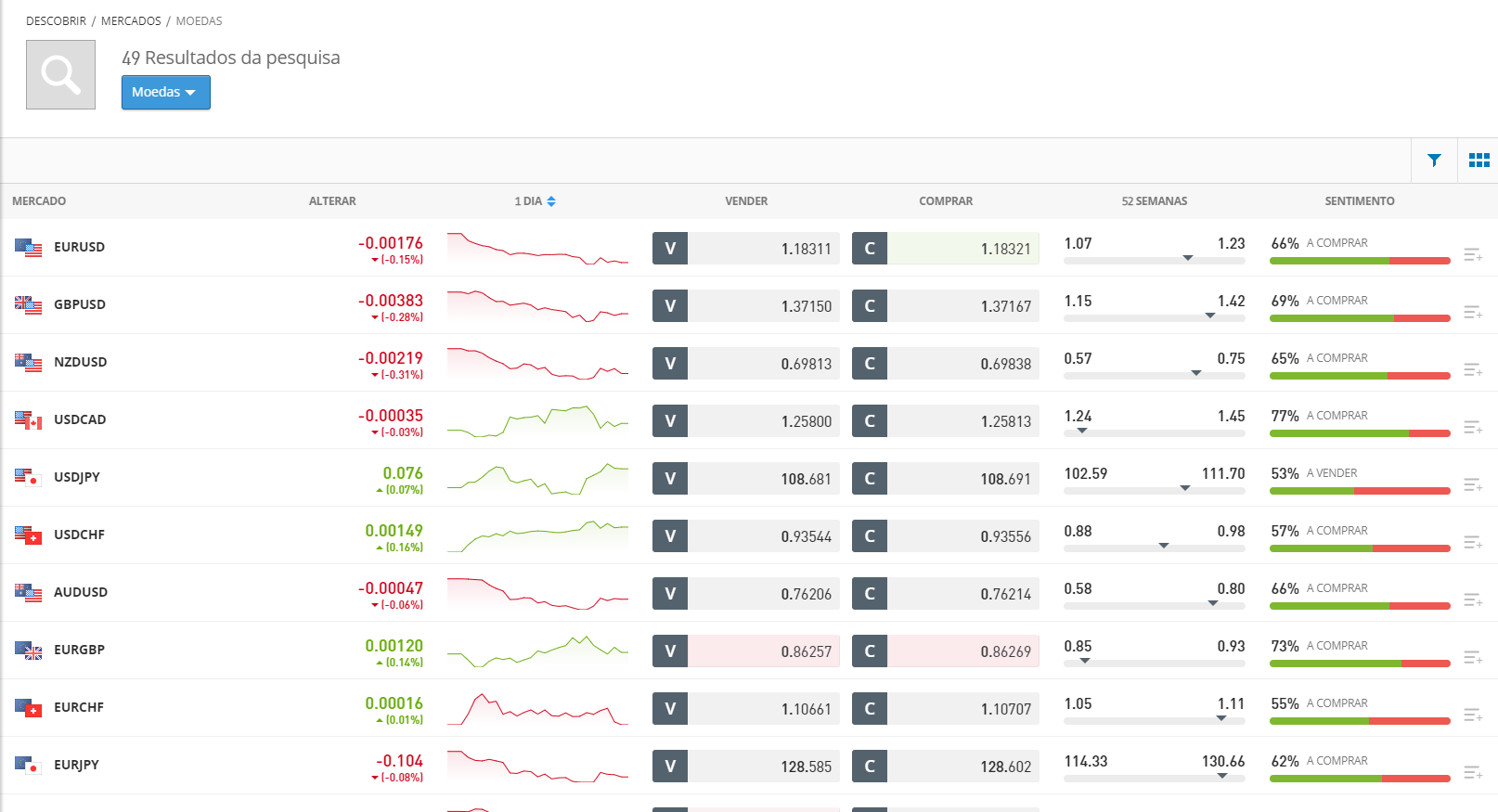

There are 7 major currency pairs and they all include the US dollar:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

These seven currency pairs make up the majority of forex trading in Bulgaria and around the world. For novice forex traders, it is better to start by trading major currency pairs, as they are always available for buying and selling and usually have lower fees compared to minor or exotic currency pairs.

Minor currency pairs

There are over 20 minor currency pairs. These include currencies other than the US dollar, as well as some currency pairs involving the dollar. For example, JPY/AUD and GBP/EUR are considered minor currency pairs.

Exotic currency pairs

Exotic currency pairs cover currencies that are not traded as frequently. For example, JPY/ZAR and EUR/HUF are exotic currency pairs. Exotic currency pairs can be very illiquid because there are not many people buying and selling them frequently, so they are more suitable for advanced traders.

Why trade forex?

The currency market has several characteristics that make online forex trading suitable for beginners. We will look at some of them.

Accessibility

For many traders, the most attractive feature of the forex trading market is its extreme accessibility. Few markets allow trading at any time, as long as you have access to your computer or mobile device.

The Forex market operates 24 hours a day, and you can always get involved in trading. There are few restrictions on what currencies you can trade, especially when compared to the stock market, where most stock brokers offer stocks from only a few countries.

It doesn’t take a lot of money to start trading forex in Bulgaria. Most of the best forex brokers require a minimum initial investment to start buying and selling currency pairs.

Liquidity

Since a huge amount of currency is traded every day, it is almost guaranteed that you will find a buyer for the currency you are selling. This is called liquidity – having a constant flow of tradable currency pairs around the world.

Liquidity is a good thing because the chance of not being able to sell your position when you want to is small. High liquidity is also important because it keeps the cost of your transactions low. We will look at forex trading fees and how they are affected by liquidity a little further down the text.

Two-way trade

The other great thing about forex trading is that you can bet that the value of a currency will fall (against another currency) as well as that it will rise. When you short a currency, you profit when it loses value. This gives you more flexibility to hedge your currency positions and create more complex currency trading strategies.

Leverage

A key part of forex trading in Bulgaria is the ability to trade with leverage. This means borrowing money from your online forex trading broker to increase the effective size of your trade. For example, if you open a position with 10:1 leverage, you can buy £1,000 worth of currency with just £100 in your trading account.

The main advantage of using leverage is that it multiplies your returns. Assuming you buy GBP/USD at 10:1 leverage, if the value of the dollar rises by 1% against the British pound, the value of your position will jump by 10%.

When you apply leverage, you can profit significantly from even small changes in the value of currency pairs. It is also possible to invest in several different currency pairs to hedge your positions. Either way, the investment is small, and you open large positions.

Forex trading fees

One of the most enticing facts about Forex trading in Bulgaria is that it is almost always commission-free. Instead of charging a flat fee for each trade, most Forex brokers charge a spread.

The spread is the difference between the bid and ask price for a currency pair. Spreads vary depending on the currency pair and the broker, ranging from 0.05% to around 1% and above. In general, spreads are lowest for major currency pairs and highest for exotic ones.

You should keep in mind that if you trade with leverage, you will likely have to pay additional fees. Most forex brokers charge an overnight fee if you hold a leveraged forex position after 10:00 PM GMT, even though the forex market never sleeps. So if you use leverage, don’t hold positions for more than a few hours.

Risks of Forex Trading in Bulgaria

Forex trading, like all types of trading, is risky. There is always a chance that the trade will backfire and the value of your positions will fall.

Forex trading, like all types of trading, is risky. There is always a chance that the trade will backfire and the value of your positions will fall.

If this happens, you will realize a loss. Instead of selling at a loss, you can try to hold the position if you are hoping for a turnaround, but there are no guarantees that this will happen, and there is a risk of increasing your losses.

Using leverage significantly increases the risk in forex trading in Bulgaria. First, losses are multiplied. Just as a 1% gain in the value of a currency pair translates into a 10% return when trading with 10:1 leverage, a 1% loss in value will mean a 10% drop in the value of your position.

Remember that you are borrowing money from your online forex trading broker when you trade with leverage. Most forex brokers require you to cover the value of your position with money in your account if it starts to lose value. So you may find yourself forced to fund your account further, or your broker will sell your position at a loss.

Given these additional risks, novice forex traders should be very careful when using leverage.

Forex Trading Strategies

If you want to have any chance of getting rich from Forex trading, it is important to have a solid currency trading strategy. There are as many Forex trading strategies as there are traders in the trading market.

Each trader develops their own, personalized strategy tailored to their financial goals, risk appetite, and trading style. The process takes time and requires experience, so we recommend starting trading with a demo account to gauge what works for you.

Let’s look at three Forex day trading strategies you can try.

Scalping

Scalping is a short-term trading strategy for buying and selling currency pairs during the day. The goal of scalping is for traders to take advantage of very small market movements that last from a few seconds to a few minutes. Scalpers carefully monitor technical indicators to identify entry and exit points.

The price movements in scalping are small, so the returns from individual trades can be as small as a fraction of a percent. However, if you make enough winning trades during the day, the returns will multiply.

Swing trading

Swing trading is a medium-term forex trading strategy. Swing traders typically look for momentum in the value of a currency pair.

Ideally, you would enter a currency trade after a strong reversal where the value begins to fall or increase on high trading volume. This strategy requires you to hold on to the trade as long as the currency pair continues to move in a certain direction and then sell as soon as the trend begins to fluctuate.

Aggressive swing traders can also speculate on the reverse trend if one develops.

News trading

Much of the volatility in the currency trading market is driven by news. Global events, politics, weather, trade agreements, and financial reports can cause a currency to rise or fall in value.

A powerful forex trading strategy is to monitor market news to predict whether a country’s currency is likely to gain or lose value in the short or long term. Based on this analysis, you can trade forex.

Forex Trading

Many intermediate and advanced traders choose to automate their Forex trading. Automation can not only take some of the work out of day trading, but it can also remove the psychological element of trading that often leads to poor decision-making.

There are two main methods to automate your forex trading: forex signals and forex robots.

Forex trading signals

Forex signals are a set of technical indicators and news tracking tools. With forex signals, you receive an alert on your computer or smartphone when a certain set of parameters is met.

For example, you can set indicators that, when achieved, will trigger a signal that will give you information about a specific currency pair to help you decide whether to enter or exit the trading market.

Forex signals can be created manually or artificial intelligence can be applied to improve them over time. You can also purchase professionally made forex signals through your broker or other online forex trading platform.

Forex trading robots

Forex robots take forex signals to the next level by fully automating trades. Bots use forex signals to identify and alert you to potential opportunities, as well as trade on your behalf. Trading robots can operate 24/7, making them particularly suitable for automated forex trading.

Forex Trading Tips

Forex trading in Bulgaria is accessible, but it’s important to know what you’re doing before you take action. Here are five tips to apply when entering the currency markets

1. Prepare with a forex trading course

Our guide is a great starting point to learn more about forex trading. However, before you start making financial bets, it is important to take a complete Forex trading course. You can find a high-quality trading course through your broker or through professional trading services online.

2. Read the best forex trading books

Professional traders have been perfecting their forex trading strategies and techniques for years. With their books, you can learn some of their most useful tricks.

We recommend ‘Forex for Beginners: What You Need to Know to Get Started, and Everything in Between’ by Anna Kuhling and ‘How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life’ by Courtney Smith.

3. Start with a forex demo account

With a demo account, you can practice with your broker’s forex trading platform, access real-time price data, and monitor the results of your trades without risking losing real money.

4. Start with small amounts

When you open a real account, start with a small investment. Focus on one or two currency pairs rather than trying to trade everything. Try trading without leverage or with only low levels of leverage to limit your losses.

5. Use stop-loss orders

One of the best things you can do to limit your risk when trading forex is to use a stop-loss option. With a stop-loss, your broker will automatically sell your position if its value falls below a pre-set level. A stop-loss is especially important in forex trading because the trading market is active 24/7 and you can’t always monitor your trades.

The best forex trading platforms

To enter the forex trading market in Bulgaria, you will need to choose a forex trading platform. Look for a platform with low spreads, high leverage, and access to a wide range of currency pairs. Here are our favorite platforms:

1. eToro – One of the best forex trading platforms in Bulgaria

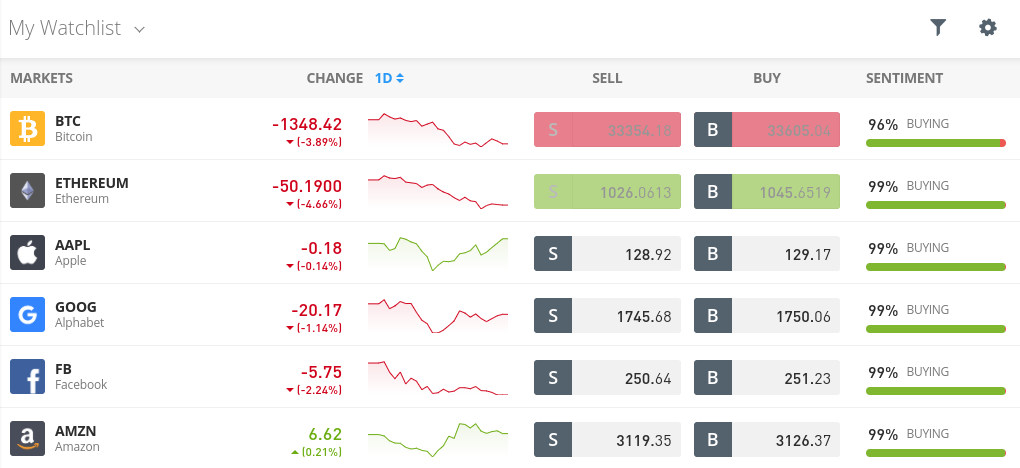

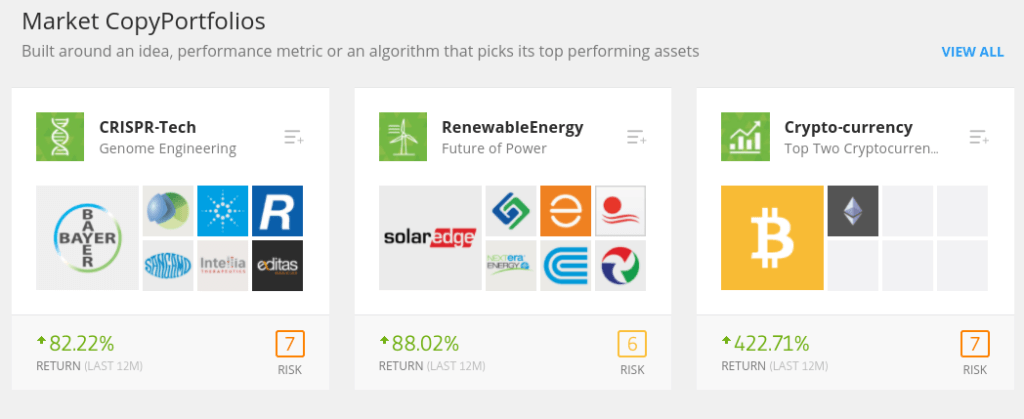

eToro offers one of the best forex trading platforms in Bulgaria. This forex broker has a social trading network where you can interact with thousands of other traders from all over the world.

You can see what currencies other investors are trading, start discussions, and gauge market sentiment. You can also set up copy trading, a kind of automatic mirroring of expert traders’ forex positions.

eToro also has an exceptional charting platform with dozens of technical studies built in. Through the platform, you can follow market news to stay up to date with market developments. The only downside is that you cannot set up forex signals through the eToro platform.

eToro does charge some account fees, including withdrawal fees, but these are relatively low and easy to avoid. You can trade major currency pairs with leverage of up to 30:1.

Advantages:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

2. AvaTrade – Forex broker with a large range of account types

![]() AvaTrade is a forex broker that offers a wide range of different account types, including CFD trading, options trading, and swap-free. It’s great to trade with a broker with such variety because it gives you flexibility in different market conditions.

AvaTrade is a forex broker that offers a wide range of different account types, including CFD trading, options trading, and swap-free. It’s great to trade with a broker with such variety because it gives you flexibility in different market conditions.

The broker also offers a full range of trading platforms, which includes MetaTrader 4, MetaTrader 5, AvaOptions, AvaSocial, and AvaTradeGO. You can perform algorithmic trading, options trading, social trading, and copy trading on desktop, web, and mobile platforms.

You can trade 1250+ global markets, including all major, minor and exotic currency pairs, commission-free. To ensure investor peace of mind, AvaTrade is regulated in six jurisdictions, including the CBI, ASIC, FSA, FSCA, FRSE and BVI FSC.

Advantages:

Disadvantages:

Вашия капитал е в риск.

3. Libertex – Forex broker with zero spreads

Libertex is a CySEC regulated forex broker that offers a unique feature – zero spreads! Typically, brokers make money from the bid and ask prices and commissions on buying and selling.

Libertex is a CySEC regulated forex broker that offers a unique feature – zero spreads! Typically, brokers make money from the bid and ask prices and commissions on buying and selling.

With Libertex you will pay a small commission on your buys and sells with zero spreads. You can trade currencies via CFDs, which means you can potentially profit from market ups and downs.

The broker offers a wide range of accounts with a VIP+ account that gives a 50% commission discount and many other additional trading features. The broker also offers its own, functional web platform that has a full set of sentiment indicators, real-time news and other features.

Advantages:

Disadvantages:

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

How to start trading forex in Bulgaria – a guide to forex trading with eToro

Ready to trade forex? We’ll show you the steps to place your first order on eToro.

Go to the homepage and click “Join” to create a new account. Enter a username and password, as well as your personal details – name, date of birth, email, phone. To meet legal requirements, you are required to verify your identity. Upload a copy of your driver’s license or passport, plus a copy of a recent utility bill or bank statement to verify your address. It’s time to make a deposit into your account. You have the option to pay by debit or credit card, e-wallet or bank transfer. For your initial transfer you must deposit at least £140. Once you have made your deposit, you can then place your first trade. Search for a currency pair in the dashboard, click on “Trade” and open a new order form. In the form, indicate the currency and the amount you would like to trade, as well as whether you are buying or selling a currency pair. If you want to make a leveraged trade or set a stop loss, you can do so when filling in the details. When you are finished, click “Trade” to complete your order.Step 1: Open a forex trading account

Step 2: Deposit funds into the account

Step 3: Place a forex order

Forex trading gives you access to a fast-growing global market that operates 24 hours a day. With forex trading, you can speculate on the price of one currency against another. The forex market is widely accessible because it is global in nature and requires a small initial investment. If you’re ready to trade forex in Bulgaria, open an eToro account today! Click the link below to get started!

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)In conclusion

eToro – The best forex trading platform in Bulgaria

Frequently Asked Questions

How does forex trading work?

What are pips in forex trading?

How does margin work in forex trading?

Is forex trading halal?

What is the best forex trading app?

Is Forex trading profitable?